Get TAP savvy with PG&E’s Technical Assistance Program (TAP)

March 21, 2023

National Diversity Coalition Completes Precautionary Forensic Audit

August 22, 2023Thank You For Attending

A Virtual Town Hall by National Diversity Coalition

A Virtual Town Hall by National Diversity Coalition

Thursday, March 23rd, 2023

NDC Banking Crisis Town Hall Explores Implications of Silicon Valley Bank Failure

March 30, 2023

As Reported by Dennis Santiago

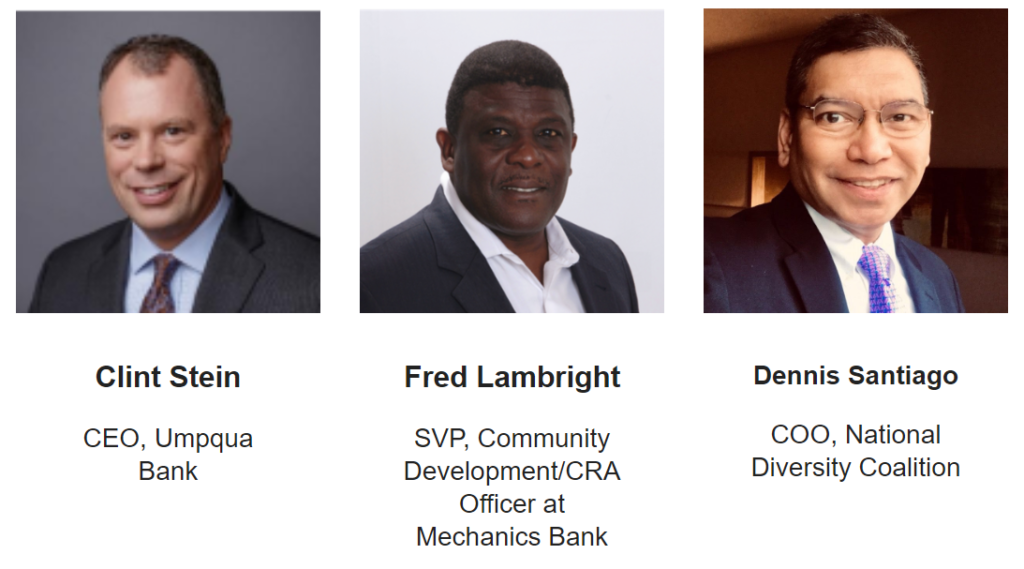

The National Diversity Coalition hosted “Banking Crisis: What We Need To Know” virtual town hall on March 23, 2023 which attracted 118 registered attendees for a panel discussion moderated by former Acting Comptroller of the Currency, Brian Brooks, to discuss confidence in the US banking system following the failure of Silicon Valley Bank (SVB) based in California and Signature Bank based in New York. The panel included Columbia Banking Systems CEO/Umpqua CEO, Clint Stein, Mechanics Bank SVP Community Development CRA Officer, Fred Lambright, and NDC’s COO, Dennis Santiago.

The town hall featured an opening address by FDIC San Francisco Regional Office Director, Kathy Moe, whose office took receivership of Silicon Valley Bank after it was failed by the California Department of Financial Protection and Innovation. Ms. Moe shared the assurance that the FDIC was working diligently to resolve the fate of the, by then, receivership Silicon Valley Bridge Bank and the FDIC’s commitment to continue to protect SVB’s depositors, including its uninsured depositors, to the extent possible.

Due to the direct oversight of Ms. Moe’s office of the situation, the details of her commentary were limited. But by the time of the NDC Town Hall, the initial auction to sell the bank in an FDIC purchase and assumption had failed and the holding company SVB Financial Group had declared Chapter 11 bankruptcy, paving the way to break up the assets of the bank for sale piecemeal. The FDIC had also activated the Systemic Risk Exception (SRE) which allows the FDIC to extend deposit protection beyond the normal $250,000 limit in order to prevent contagion to additional banks.

Mr. Brooks opened the panel portion of the discussion by reviewing the main elements that triggered the collapse of SVB. He noted the toxic combination of a large portfolio of low yielding held to maturity treasury and agency assets held by SVB combined with a documented 86% of the bank's deposits being uninsured deposits. Brooks pointed out that equity analysts on Wall Street who detected this condition had signaled on the Internet that if a major run on the bank were to occur, SVB would be forced to sell these assets prematurely at a loss that would be insufficient to cover payments to depositors seeking to withdraw their money. These Wall Street concerns that the equity value of SVB could evaporate went viral. Over $40 billion hemorrhaged out of SVB in one day rapidly leading to the institution’s insolvency and failure.

Mr. Brooks noted to the audience that, in the aftermath of SVB's failure, Wall Street analysts had begun to recommend that corporate clients maintain limited balances in commercial accounts in at least two banks that they could rapidly wire all of their money back and forth and in between if one were to fail, and maintain the rest there assets in treasury ladder investment portfolios structured to support their expected cash flow requirements. Brooks further pointed out to the audience that this is a costly and labor intensive way of managing cash and cash equivalents for any company. It would be much better to put the entire balance in a bank you knew you could rely on being there when you need it. The fear expressed to the panel was that regional and community banks might suffer deposits running from them to large national banks in a flight to safety that could undermine the viability of the mid-size and small bank industry in the United States.

Mr. Brooks started by asking the two bankers on the panel for their reactions to these opening remarks. Both Mr. Stein from Umpqua and Mr. Lambright from Mechanics Bank were quick to note their banks did not have the distended exposure of large low-yielding fixed income portfolios facing opposite excessively large percentages of uninsured deposits on their balance sheets. They pointed out that these internal stress factors are anomalies within the banking industry.

Mr. Brooks then pressed the bankers on the question of unlimited deposit insurance that had been given to SVB and to another failure case, Signature Bank of New York, by the FDIC. He asked the bankers if they thought the FDIC deposit insurance needed to be raised to a higher level or even be made unlimited as had been done only for SVB and Signature customers through the SRE exception. Mr. Stein pointed out that his bank had the capability to provide enhanced deposit insurance protection to customers up to $150 million through the use of commercial reciprocal deposit networks without needing the SRE exception.

Brooks then turned to NDC’s Dennis Santiago for the community advocacy and main street perspective. Santiago first noted that most ordinary Americans will never be exposed to uninsured deposit losses because the balances in their bank accounts are not generally above the current $250,000 FDIC limit. However, NDC is also aware that many small and medium sized businesses do regularly process transactions through their banks well over $250,000 which means that they will have balances in their commercial accounts that are above the FDIC limit. He pointed out that the concern for these businesses is that they need assurances that their money will be there to support wiring their transactions at all times. Many of these businesses make extensive use of regional, community and business banks for their commercial activities. A run on deposits at these smaller institutions would be detrimental to America's small and medium sized businesses. Therefore, NDC advocates that these smaller banks need to be protected in order to protect the broader U.S. economy.

Santiago noted that, from a public policy perspective, it is unclear if raising the deposit limit for FDIC insurance will help or hurt the situation. Raising the limit to cover the average balances of commercial accounts would mean a massive spike in how large the Deposit Insurance Fund (DIF) would have to be. The US DIF is around $182 billion or roughly 1.27% of total insured deposits. If FDIC limits are raised this number must grow and Santiago noted that the FDIC would have to charge banks increased insurance fees to cover these new level of consumer and commercial protection.

Mr. Santiago supported the notion raised by Mr. Stein that insurance enhancement programs like reciprocal deposited that spread FDIC insurance for large balance accounts across networks of banks ranging from 500 to 3,000 participating banks offer solutions for large accounts in the $50m to $150m balance range. But it would not protect the super-large deposit accounts of investment funds such as the top 10 depositors of SVB who had a combined balance of over $15 billion; only the SRE exception can protect that exposure. Mr. Brooks concluded the deposit insurance discussion by asking if the FDIC itself could be the agent of reciprocal deposit network protection supplanting commercial solutions.

Brooks then returned to the question of blame for the failure of SVB. He asked if bank management bore the responsibility for the failure or if regulatory policy, particularly interest rate policy, was the driving factor in the failure of both SVB and Signature. The response was mixed. Both Mr. Stein and Mr. Lambright were of the opinion that the blame rested solely in the hands of bank management. They never should have let their banks get boxed into untenable positions.

Mr. Santiago was not as harsh on the bankers noting that during the decade of quantitative easing, regulators encouraged banks to invest in low-yielding treasury and agency assets, building a book of what banks were told were “safe” cash equivalent assets that should be held to maturity. Regulators did not focus on the fire sale risk from a deposit run of these assets having to be disposed of at a loss. SVB may have been slow to recognize the danger of their distended position and it took Wall Street analyst looking at the equity implications to shareholders to manifest the threat; but regulators had told them the paper was good as cash. Note that the issuing agencies of that government paper do not have redemption at face value provisions in this paper.

Mr. Brooks closed this portion of the town hall with the opinion that regulators and bank share equally in the blame for these failures. In particular, Brooks noted that different departments within government agencies may not be doing enough to coordinate what one part of the apparatus is doing with others. In this case, Brooks asked if the department looking at interest rate policy was coordinating enough with other departments looking for unintended consequence effects and mitigating them before dramatic failures occur.

The session ended returning to Main Street with the observation that there is no reason why a business or depositor with large balances above the FDIC insurance limit should not continue to do business with a well-run regional, community or business bank with the hope that attendees learned something about how to ask better questions about whether the bank they are working with is safe and sound as asserted by participant banks, Umpqua and Mechanics, or exposed at the fringe like the now defunct Silicon Valley Bank.

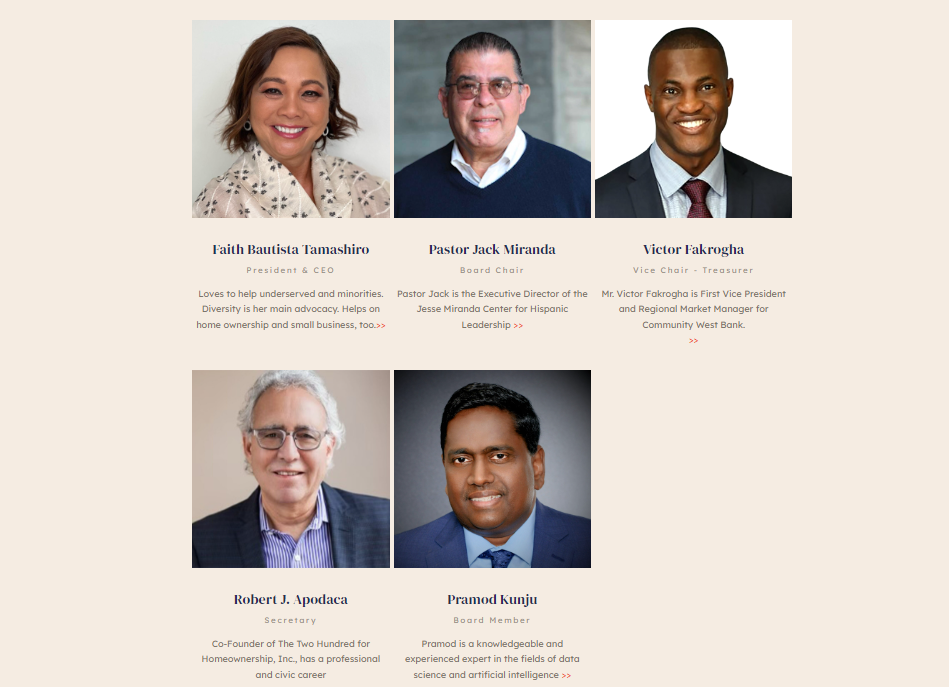

The National Diversity Coalition is a 501(c)(3) non-profit organization advocating for greater opportunity, financial equality, and economic empowerment for the diverse, minority and low-to-moderate income communities. We work with corporations and federal as well as state agencies on policies that help break down the barriers of the unbanked and underbanked, through greater corporate social responsibility, consumer protection, supplier diversity, and providing access to capital and broadband, among others.

As Reported by Dennis Santiago

The National Diversity Coalition hosted “Banking Crisis: What We Need To Know” virtual town hall on March 23, 2023 which attracted 118 registered attendees for a panel discussion moderated by former Acting Comptroller of the Currency, Brian Brooks, to discuss confidence in the US banking system following the failure of Silicon Valley Bank (SVB) based in California and Signature Bank based in New York. The panel included Columbia Banking Systems CEO/Umpqua CEO, Clint Stein, Mechanics Bank SVP Community Development CRA Officer, Fred Lambright, and NDC’s COO, Dennis Santiago.

The town hall featured an opening address by FDIC San Francisco Regional Office Director, Kathy Moe, whose office took receivership of Silicon Valley Bank after it was failed by the California Department of Financial Protection and Innovation. Ms. Moe shared the assurance that the FDIC was working diligently to resolve the fate of the, by then, receivership Silicon Valley Bridge Bank and the FDIC’s commitment to continue to protect SVB’s depositors, including its uninsured depositors, to the extent possible.

Due to the direct oversight of Ms. Moe’s office of the situation, the details of her commentary were limited. But by the time of the NDC Town Hall, the initial auction to sell the bank in an FDIC purchase and assumption had failed and the holding company SVB Financial Group had declared Chapter 11 bankruptcy, paving the way to break up the assets of the bank for sale piecemeal. The FDIC had also activated the Systemic Risk Exception (SRE) which allows the FDIC to extend deposit protection beyond the normal $250,000 limit in order to prevent contagion to additional banks.

Mr. Brooks opened the panel portion of the discussion by reviewing the main elements that triggered the collapse of SVB. He noted the toxic combination of a large portfolio of low yielding held to maturity treasury and agency assets held by SVB combined with a documented 86% of the bank's deposits being uninsured deposits. Brooks pointed out that equity analysts on Wall Street who detected this condition had signaled on the Internet that if a major run on the bank were to occur, SVB would be forced to sell these assets prematurely at a loss that would be insufficient to cover payments to depositors seeking to withdraw their money. These Wall Street concerns that the equity value of SVB could evaporate went viral. Over $40 billion hemorrhaged out of SVB in one day rapidly leading to the institution’s insolvency and failure.

Mr. Brooks noted to the audience that, in the aftermath of SVB's failure, Wall Street analysts had begun to recommend that corporate clients maintain limited balances in commercial accounts in at least two banks that they could rapidly wire all of their money back and forth and in between if one were to fail, and maintain the rest there assets in treasury ladder investment portfolios structured to support their expected cash flow requirements. Brooks further pointed out to the audience that this is a costly and labor intensive way of managing cash and cash equivalents for any company. It would be much better to put the entire balance in a bank you knew you could rely on being there when you need it. The fear expressed to the panel was that regional and community banks might suffer deposits running from them to large national banks in a flight to safety that could undermine the viability of the mid-size and small bank industry in the United States.

Mr. Brooks started by asking the two bankers on the panel for their reactions to these opening remarks. Both Mr. Stein from Umpqua and Mr. Lambright from Mechanics Bank were quick to note their banks did not have the distended exposure of large low-yielding fixed income portfolios facing opposite excessively large percentages of uninsured deposits on their balance sheets. They pointed out that these internal stress factors are anomalies within the banking industry.

Mr. Brooks then pressed the bankers on the question of unlimited deposit insurance that had been given to SVB and to another failure case, Signature Bank of New York, by the FDIC. He asked the bankers if they thought the FDIC deposit insurance needed to be raised to a higher level or even be made unlimited as had been done only for SVB and Signature customers through the SRE exception. Mr. Stein pointed out that his bank had the capability to provide enhanced deposit insurance protection to customers up to $150 million through the use of commercial reciprocal deposit networks without needing the SRE exception.

Brooks then turned to NDC’s Dennis Santiago for the community advocacy and main street perspective. Santiago first noted that most ordinary Americans will never be exposed to uninsured deposit losses because the balances in their bank accounts are not generally above the current $250,000 FDIC limit. However, NDC is also aware that many small and medium sized businesses do regularly process transactions through their banks well over $250,000 which means that they will have balances in their commercial accounts that are above the FDIC limit. He pointed out that the concern for these businesses is that they need assurances that their money will be there to support wiring their transactions at all times. Many of these businesses make extensive use of regional, community and business banks for their commercial activities. A run on deposits at these smaller institutions would be detrimental to America's small and medium sized businesses. Therefore, NDC advocates that these smaller banks need to be protected in order to protect the broader U.S. economy.

Santiago noted that, from a public policy perspective, it is unclear if raising the deposit limit for FDIC insurance will help or hurt the situation. Raising the limit to cover the average balances of commercial accounts would mean a massive spike in how large the Deposit Insurance Fund (DIF) would have to be. The US DIF is around $182 billion or roughly 1.27% of total insured deposits. If FDIC limits are raised this number must grow and Santiago noted that the FDIC would have to charge banks increased insurance fees to cover these new level of consumer and commercial protection.

Mr. Santiago supported the notion raised by Mr. Stein that insurance enhancement programs like reciprocal deposited that spread FDIC insurance for large balance accounts across networks of banks ranging from 500 to 3,000 participating banks offer solutions for large accounts in the $50m to $150m balance range. But it would not protect the super-large deposit accounts of investment funds such as the top 10 depositors of SVB who had a combined balance of over $15 billion; only the SRE exception can protect that exposure. Mr. Brooks concluded the deposit insurance discussion by asking if the FDIC itself could be the agent of reciprocal deposit network protection supplanting commercial solutions.

Brooks then returned to the question of blame for the failure of SVB. He asked if bank management bore the responsibility for the failure or if regulatory policy, particularly interest rate policy, was the driving factor in the failure of both SVB and Signature. The response was mixed. Both Mr. Stein and Mr. Lambright were of the opinion that the blame rested solely in the hands of bank management. They never should have let their banks get boxed into untenable positions.

Mr. Santiago was not as harsh on the bankers noting that during the decade of quantitative easing, regulators encouraged banks to invest in low-yielding treasury and agency assets, building a book of what banks were told were “safe” cash equivalent assets that should be held to maturity. Regulators did not focus on the fire sale risk from a deposit run of these assets having to be disposed of at a loss. SVB may have been slow to recognize the danger of their distended position and it took Wall Street analyst looking at the equity implications to shareholders to manifest the threat; but regulators had told them the paper was good as cash. Note that the issuing agencies of that government paper do not have redemption at face value provisions in this paper.

Mr. Brooks closed this portion of the town hall with the opinion that regulators and bank share equally in the blame for these failures. In particular, Brooks noted that different departments within government agencies may not be doing enough to coordinate what one part of the apparatus is doing with others. In this case, Brooks asked if the department looking at interest rate policy was coordinating enough with other departments looking for unintended consequence effects and mitigating them before dramatic failures occur.

The session ended returning to Main Street with the observation that there is no reason why a business or depositor with large balances above the FDIC insurance limit should not continue to do business with a well-run regional, community or business bank with the hope that attendees learned something about how to ask better questions about whether the bank they are working with is safe and sound as asserted by participant banks, Umpqua and Mechanics, or exposed at the fringe like the now defunct Silicon Valley Bank.

The National Diversity Coalition is a 501(c)(3) non-profit organization advocating for greater opportunity, financial equality, and economic empowerment for the diverse, minority and low-to-moderate income communities. We work with corporations and federal as well as state agencies on policies that help break down the barriers of the unbanked and underbanked, through greater corporate social responsibility, consumer protection, supplier diversity, and providing access to capital and broadband, among others.

An Emergency, Virtual Town Hall by National Diversity Coalition