Assistant Attorney General Makan Delrahim Keynote Address

March 15, 2019

Governor Newsom returns 331m for struggling renters and homeowners

August 10, 2019WASHINGTON — A speech by the head of the Federal Deposit Insurance Corp. on expanding access to the underbanked and modernizing the Community Reinvestment Act turned personal on Thursday.

Jelena McWilliams, who immigrated from Serbia in the former Yugoslavia, recounted her struggles to get credit in the U.S. She teared up as she described how her father lost savings during the Yugoslavian conflict. She said regulatory policy should move banking in the direction of serving the unbanked and communities in need.

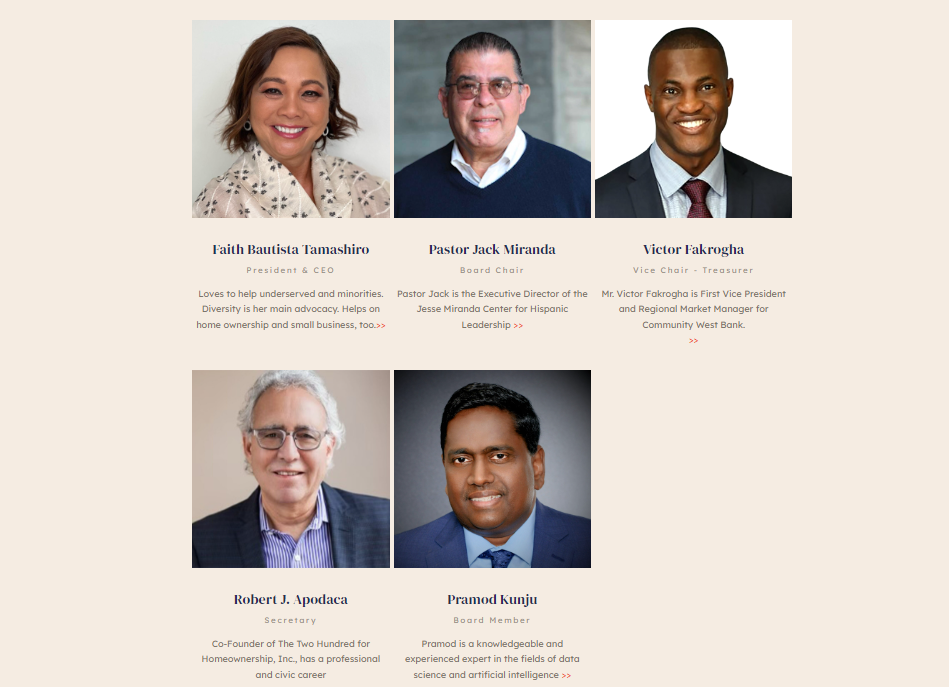

“I’m sorry for the tears, but when I assumed the chairmanship of the FDIC … in June of last year, I did so with a firm belief that people like my dad, people like me and people who are not part of the financial system need to be part of the financial system,” McWilliams said in remarks to the National Diversity Coalition. “And our regulatory framework needs to be responsive to that.”

“When I assumed the chairmanship of the FDIC … in June of last year, I did so with a firm belief that people like my dad, people like me and people who are not part of the financial system need to be part of the financial system,” said FDIC Chairman Jelena McWilliams.”Bloomberg News

McWilliams, whose remarks drew a standing ovation and caused others in the room to tear up as well, said revisiting the CRA is a key avenue to reduce levels of underbanked Americans. The 1977 law grades banks on lending to communities they serve.

“Frankly, it’s one of those issues that both people tend to get very personally involved with” and “I want you to know that I don’t take the issue lightly,” McWilliams said.

She discussed her experience in one of her first jobs in the U.S. at a car dealership in a “dilapidated” community in California.

“I was the first women ever to join their ranks as a salesperson” and one day a salesman “pulled me aside and said, ‘Listen, if you do not lose your accent you’re not going to make it in America,’ ” McWilliams said. Since then, “I’m still trying to figure out what exactly does it mean to make it in America. But as I think through all of those issues I have to tell you, my life experience has shaped heavily how I think about our regulatory framework and the role the FDIC plays in that framework.”

McWilliams said she has three priorities in revamping the CRA: clarity on what qualifies for CRA credit, how to assess emerging digital banks and making sure that CRA investments go to the exact entity in most need of credit.

“I have had an opportunity to live, work, function and call home many of the communities that the CRA is trying to address,” she said. “And I will proceed with those thoughts as we look at how to revise the framework.”

The Office of the Comptroller of the Currency was the first of three bank regulators overseeing CRA to begin the revamp process, issuing an advance notice of proposed rulemaking to solicit feedback from the public. The OCC gathered roughly 1,500 comments in November that were shared with the other agencies overseeing the law: the FDIC and the Federal Reserve. Both those agencies have not yet joined the OCC, but officials including McWilliams began talking about CRA more publicly this week.

“There has to be certainty,” McWilliams said in an interview with American Banker after her speech. “You shouldn’t be ever in a position where you don’t know if an investment qualifies and in what way.”

Comptroller of the Currency Joseph Otting has long talked about his own initial plan that partly involves clarifying how to assess banks for CRA. But it went several steps further by floating a new measurement system and expanding assessment areas, which received heavy criticism from consumer groups.

Just this week, Fed Gov. Lael Brainard also came forward with a plan to tackle CRA that includes creating separate assessment areas between retail and community development activities, and tailoring certain CRA requirements based on bank size.

“Small banks could have their lending and retail services evaluated under the retail test, while larger banks could be evaluated under both the retail and community development tests,” Brainard said in a speech Tuesday before the National Community Reinvestment Coalition.

When asked about Brainard’s plan, McWilliams said she had not yet read it or received a draft proposal from the OCC. But she was open to all ideas.

“I haven’t seen a new framework that will be proposed, so I’m an open book. I will take all of this,” McWilliams said. But “it has to make sense. And it has to make sense in a way that makes sense both for banks and consumers.”